Mississippi Jobs Tax Credit

Work opportunity tax credit wotc program.

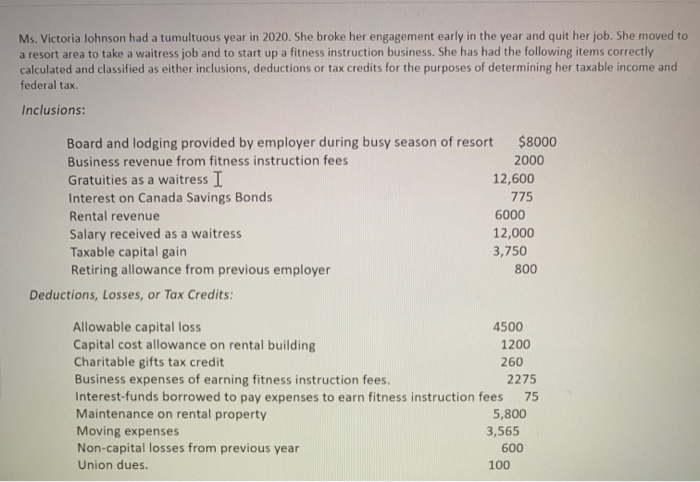

Mississippi jobs tax credit. Mississippi state rd skills tax credit. Mississippi state rd tax credits mississippi provides an income tax credit for new jobs requiring research and development skills. The credit shall not exceed 10000 or the amount of tax imposed upon the eligible owner for the taxable year reduced by the sum of all other credits allowable to the eligible owner except for withholding credits estimated tax payments andor credit for tax paid to another state.

The credits are earned by certain types of businesses that create and sustain new jobs in mississippi. However an application must be submitted to lock in the county. The total of the jobs tax credit the headquarters credit and the research development skills credit is limited to 50 of the mississippi income tax liability.

Listed below are credits that are available on your mississippi return. Employers must be certified as eligible for the tax credit by the local community or junior college that serves the employer and the mississippi state tax commission. Stacey morrison created date.

Creating an account allows you post job openings to mississippis largest job board where hundreds of qualified job seekers are actively searching for jobs. An application for this credit is not required. The credit is not refundable.

Create an employer account. Certification of the credit. For questions about this group contact us by email at wotcservicesatmdesmsgov or by phone at 601 321 6013.

Manufacturing aerospace agribusiness existing income shipbuilding all. Additionally the state provides a rebate for investors qualified research costs. Qualified wages are capped at 6000 with a maximum tax credit of 2400 depending upon the number of hours worked.

This credit is an amount equal to the lesser of 50 of the actual costs of approved practices or 50 of the average cost of approved practices. The form prescribed by the commissioner which shows the computation of the credit must be attached to the mississippi state income tax return.

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png)